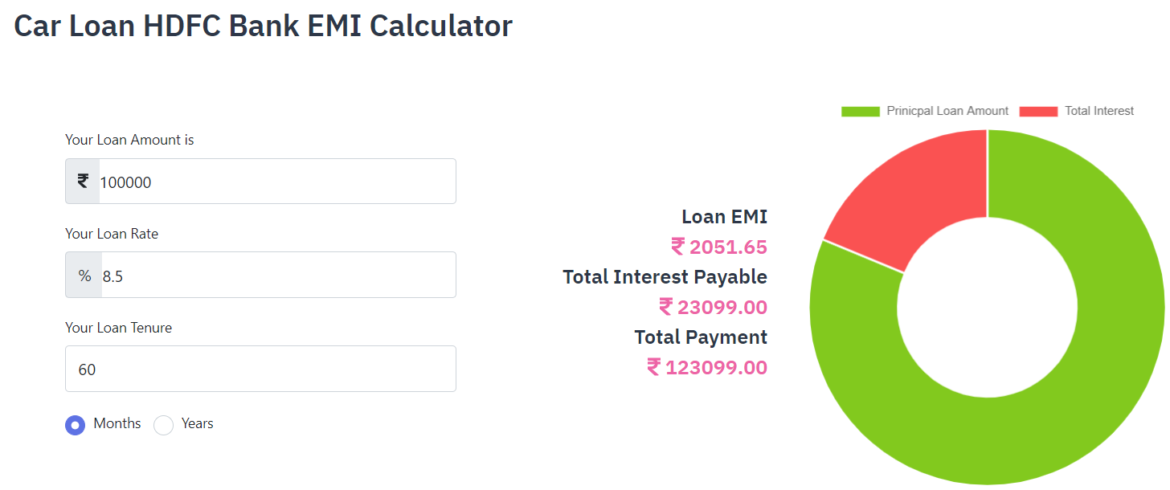

The HDFC Car loan calculator is an online tool that helps you figure out the cost of a car loan. You can enter various parameters, including loan amount, tenure, interest rate, processing fee, and prepayment option, and the calculator will then calculate the total amount to be paid over the life of the loan. It will also show you the amortization schedule.

Fixed rate of interest

Fixed rate of interest on a car loan is a term which means that the interest rate is fixed and cannot change. You can save money by choosing a fixed rate of interest. However, you should know that fixed rates come with a higher interest than floating rates. This rate of interest is a good option if market conditions are favorable. However, if you are in a situation where the market is not so favorable, you may want to consider taking a floating rate of interest.

In order to get a loan from HDFC Bank, you will need a decent credit score. This can be checked using a Free Credit Score tool. This tool will give you the information you need to know and help you take necessary action to improve your credit score. Once you know your score, you can approach the bank with confidence.

An HDFC car loan calculator can also help you to choose the best tenor for your repayment plan. By using this tool, you can ensure that you are not paying too much in interest and EMI amounts are correct. It also saves you the trouble of manual calculation. And the best part is, you can use it on any device, 24 hours a day.

Flexible repayment options

When comparing car loans, it is important to find out exactly how much you can afford to borrow, as well as how long it will take to repay the loan. HDFC car loan eligibility is based on the borrower’s income and monthly expenses, so it’s vital to find the right amount and repayment terms for you.

For this reason, the lower the loan amount, the quicker the repayment term. But, a longer repayment period may reduce your eligibility for an HDFC car loan. Although longer repayment terms will mean lower EMIs, the bank may believe that you can’t afford higher repayment amounts.

To find out exactly how much you can afford to borrow, make sure to read the documentation carefully. Often, these documents will show you the interest rates and EMIs for different loan products. If you don’t understand the documentation of your loan, visit a branch or call a customer service desk to find out more information. Once you have the numbers, you can input them into the EMI Calculator tool and calculate how much you’ll owe over the course of the loan.

Processing fee

HDFC Bank charges a processing fee to process your loan application. The processing fee amounts to 0.4 per cent of the total loan amount. It starts at Rs3,000 and cannot exceed Rs10,000. In case of default, the processing fee will not be refunded. Moreover, you will be charged interest.

HDFC Bank considers a number of factors to determine the interest rate charged on your loan. These factors include your income, credit score and relationship with the bank. In addition, the age and condition of your car will play an important role in determining the interest rate. If you’re an existing customer of the bank, you’re more likely to get a discount on the interest rate.

You can check whether you qualify for an HDFC Bank car loan by visiting your local HDFC Bank branch or using an online eligibility checker. Simply enter details about your income, employment status, and ITR into the eligibility checker. Once you’ve entered all these details, the tool will instantly tell you if you’re eligible for the loan.