If you have bad credit, you may think that getting a payday loan is out of the question. But there are actually several benefits to taking out a payday loan, even if you have bad credit.

Payday loans can provide access to emergency funds when you need them most. They can also help you rebuild your credit score. And, unlike some other types of loans, there are no pre-payment penalties with payday loans.

In order to qualify for a payday loan with bad credit, you will need to meet minimum age requirements, have a regular source of income, and have an active checking account. You will also need to provide required documentation.

Applying for a payday loan with bad credit is simple. First, gather the required documents. Then, choose a lender and complete the application. Finally, receive your loan.

With a little research and effort, getting a payday loan with bad credit is possible. And it can provide much-needed financial assistance when times are tough.

The Benefits of Payday Loans for Bad Credit.

Payday loans offer bad credit borrowers access to emergency funds. In the event of an unexpected car repair, medical bill, or home repair, a payday loan can provide the necessary funds to avoid costly overdraft fees or late payment penalties.

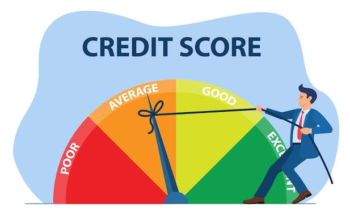

Rebuild Your Credit Score.

Another benefit of payday loans for bad credit borrowers is the opportunity to rebuild their credit score. By making timely payments on a payday loan, borrowers can improve their credit score and eventually qualify for traditional forms of credit.

No Pre-Payment Penalties.

Finally, most payday lenders do not charge pre-payment penalties, meaning that borrowers can pay off their loan early without incurring any additional fees. This flexibility can be helpful for those who are working to improve their financial situation.

How to Qualify for a Payday Loan with Bad Credit.

In order to qualify for a payday loan, you must be at least 18 years old. This is the legal age of adulthood in the United States, which means that you are considered responsible for your own actions and can enter into contracts without a cosigner.

Have a regular source of income.

To qualify for a payday loan, you must have a regular source of income. This could come from a job, disability benefits, Social Security benefits, or other sources. The lender will need to see proof of your income in order to determine whether or not you can afford to repay the loan.

Have an active checking account.

In order to qualify for a payday loan, you must have an active checking account. This is because the loan will be deposited into your account and you will be required to repay it through automatic withdrawals from your account. The lender will need to see proof of your checking account in order to determine whether or not you qualify for the loan.

Provide required documentation.

In order to qualify for a payday loan, you may be required to provide some documentation. This could include proof of income, proof of identity, and proof of residency. The lender may also require that you provide them with a copy of your most recent bank statement. The lender will use this information to determine whether or not you qualify for the loan.

How to Apply for a Payday Loan with Bad Credit.

In order to apply for a payday loan with bad credit, you will need to gather the following documents:

-A copy of your most recent pay stub

-A copy of your driver’s license or other form of government-issued ID

-Your Social Security number

-Proof of residency (a utility bill, lease agreement, or bank statement)

Choose a lender.

Once you have gathered all of the required documents, you will need to choose a lender. There are many lenders who offer payday loans to people with bad credit, so it is important to compare rates and terms before choosing one.

Complete the application.

After you have chosen a lender, you will need to complete the application. This can usually be done online or in person, and will require you to provide information such as your name, address, income, and Social Security number.

Receive your loan.

Once you have completed the application and been approved for the loan, you will receive the money either via direct deposit into your checking account or in cash (if you applied in person).

Conclusion

If you have bad credit and need access to emergency funds, a payday loan can be a good option. Payday loans can help you rebuild your credit score and there are no pre-payment penalties. To qualify for a payday loan, you must meet minimum age requirements, have a regular source of income, an active checking account, and provide required documentation. Applying for a payday loan is easy – simply gather the required documents, choose a lender, and complete the application. Once approved, you’ll receive your loan and can use it as needed.

So if you’re considering a payday loan for bad credit, keep in mind the benefits and how easy they are to apply for.